How to e-Pay Income Tax Online?

How to e-Pay Income Tax Online?

Here's a step-by-step guide on how to make tax payment on the Income Tax Portal without logging in:

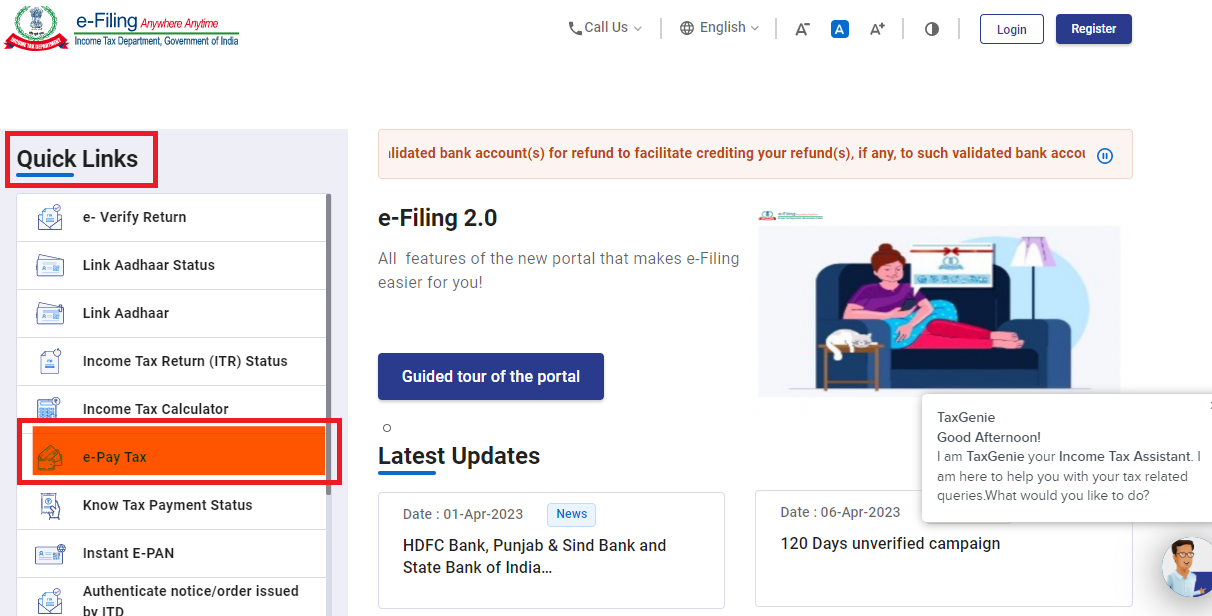

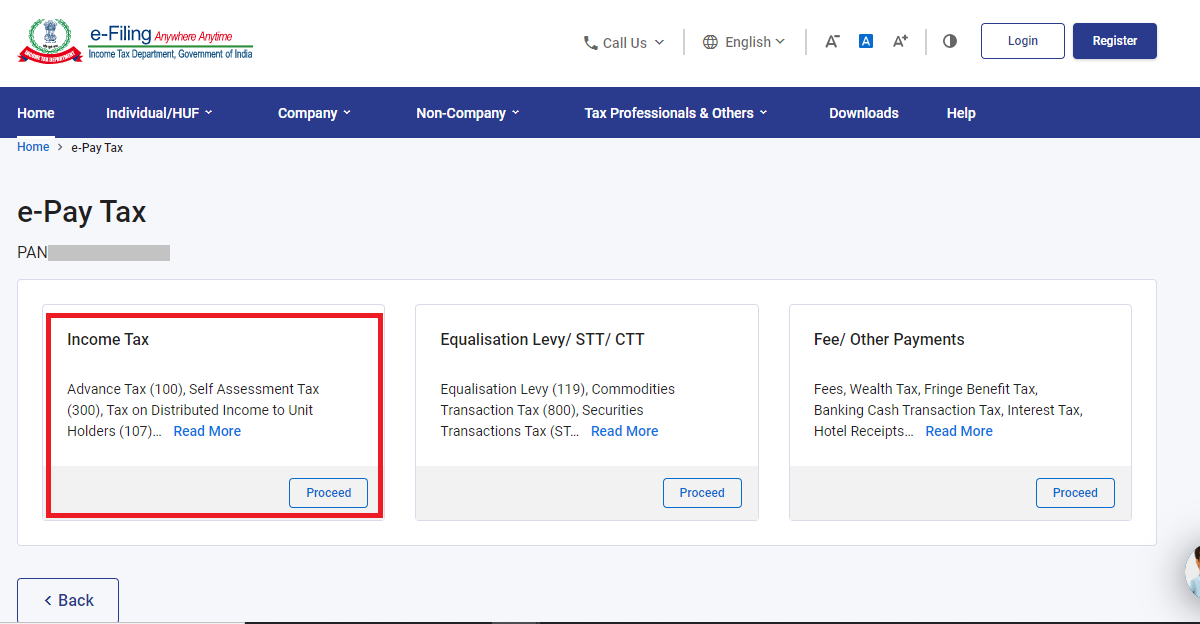

Step 1: Navigating to 'e-Pay Tax' Section

- Visit the Income Tax Portal

- On the homepage, locate the 'Quick Links' section on the left side.

- Click on the 'e-Pay Tax' option or use the search bar to find 'e-Pay Tax'.

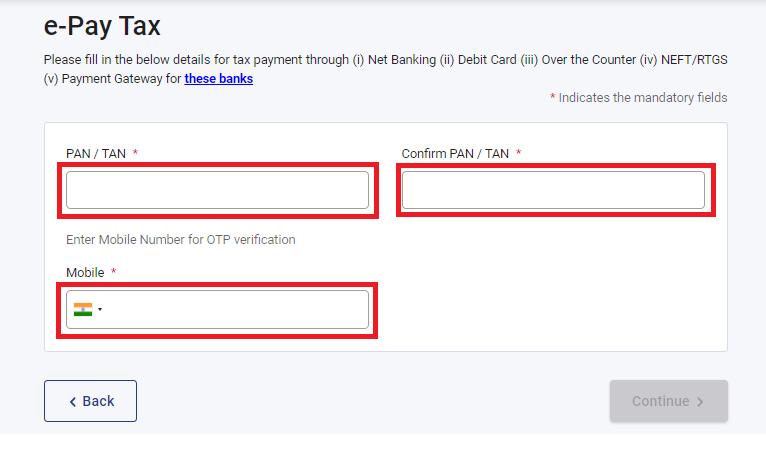

Step 2: Enter PAN/TAN and Mobile Number

- Enter your PAN and re-enter to confirm it.

- Provide your mobile number and click 'Continue'.

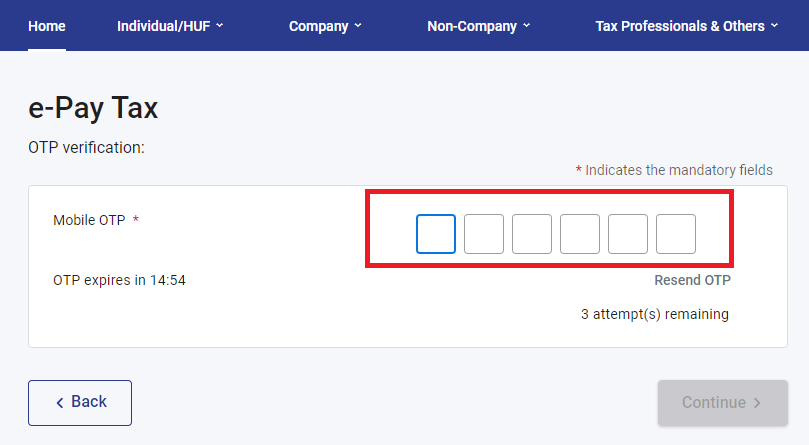

- Enter the 6-digit OTP received on your mobile number and click 'Continue'.

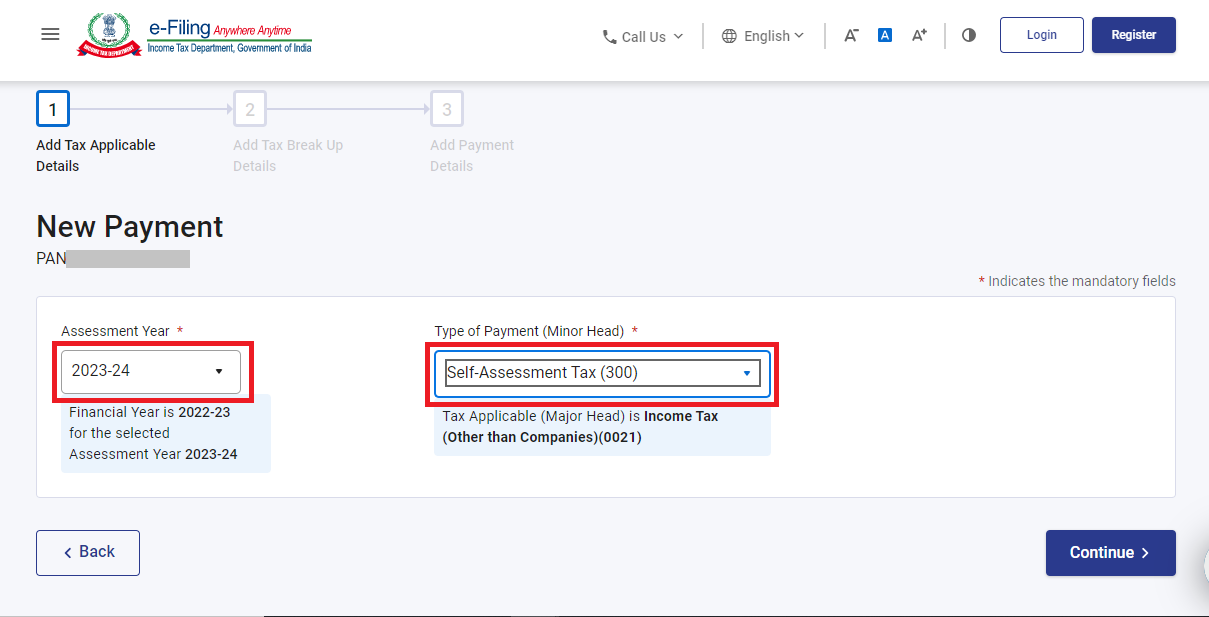

Step 3: Select the correct Assessment Year and Payment Type

- Select the first box labelled as ‘Income Tax’ and click ‘Proceed’

- From the ‘Assessment Year’ dropdown, select ‘2024-25’

- Under the ‘Type of Payment’, select ‘Self-Assessment Tax (300)’ and click on 'Continue'.

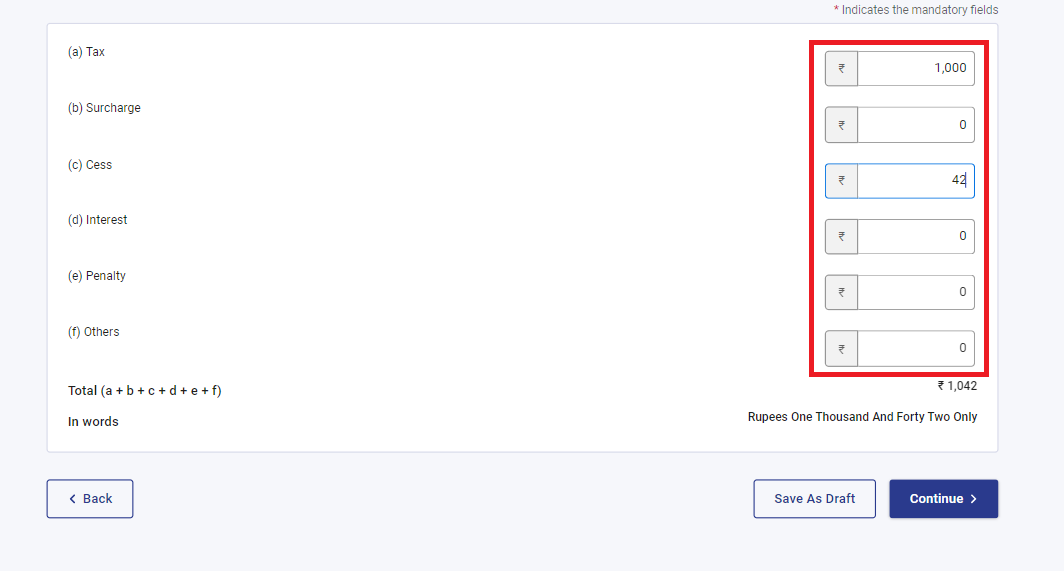

Step 4: Enter Tax Payment Details

- Enter the payment amounts accurately under the relevant categories.

- You can refer to the pre-filled challan on Cleartax for the necessary amounts.

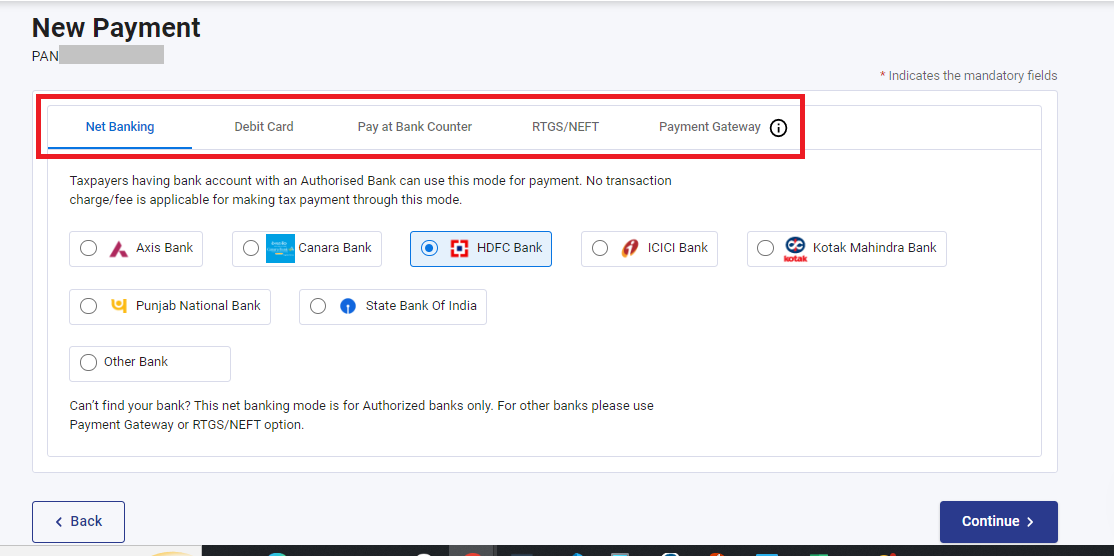

Step 5: Select the Payment Method

- Select the payment method and bank to make the tax payment and press 'Continue'.

- Payment can be made using internet banking, debit card, credit card, RTGS/NEFT, UPI or you can choose to pay at the bank counter.

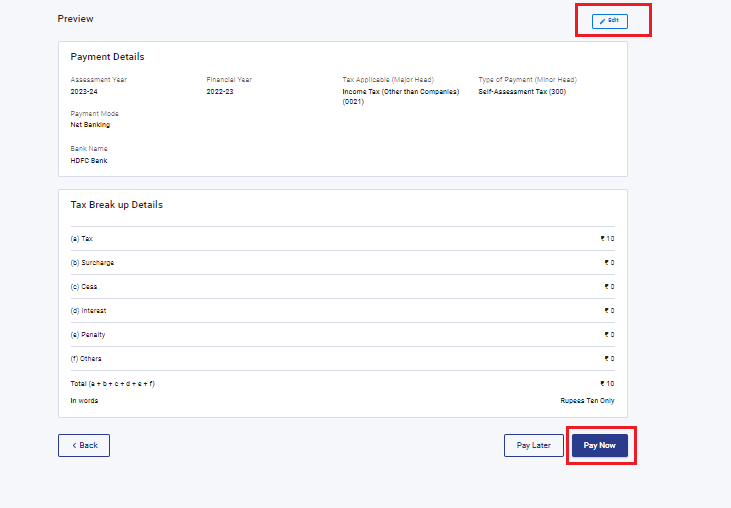

Step 6: Verify Payment Information

- After clicking 'Continue', you can preview the challan details.

- Double-check the payment information for accuracy.

- Click 'Pay Now' to make the payment or 'Edit' to modify the details.

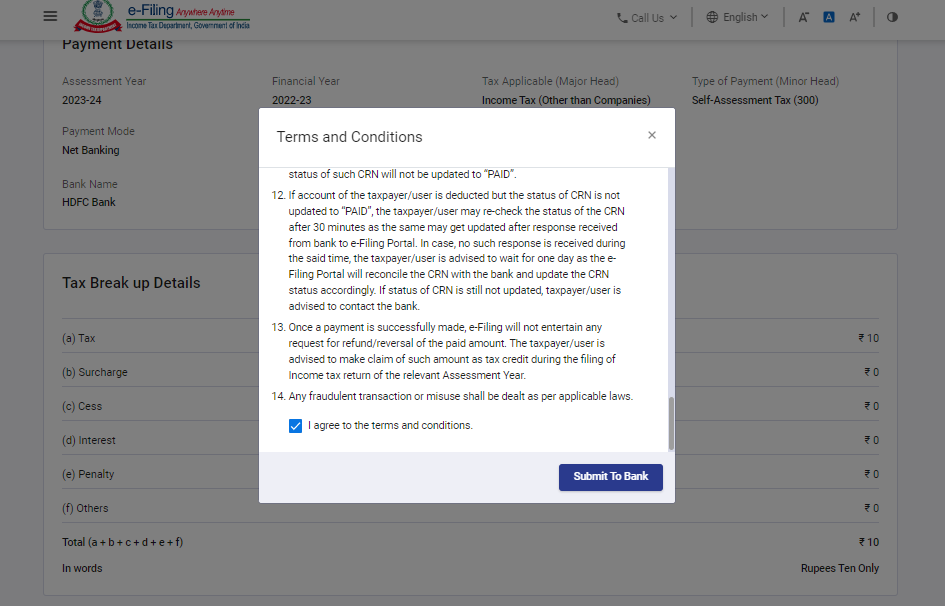

Step 7: Submit the Payment

- Tick the checkbox to agree to the Terms and Conditions.

- Click 'Submit To Bank' to proceed with the payment.

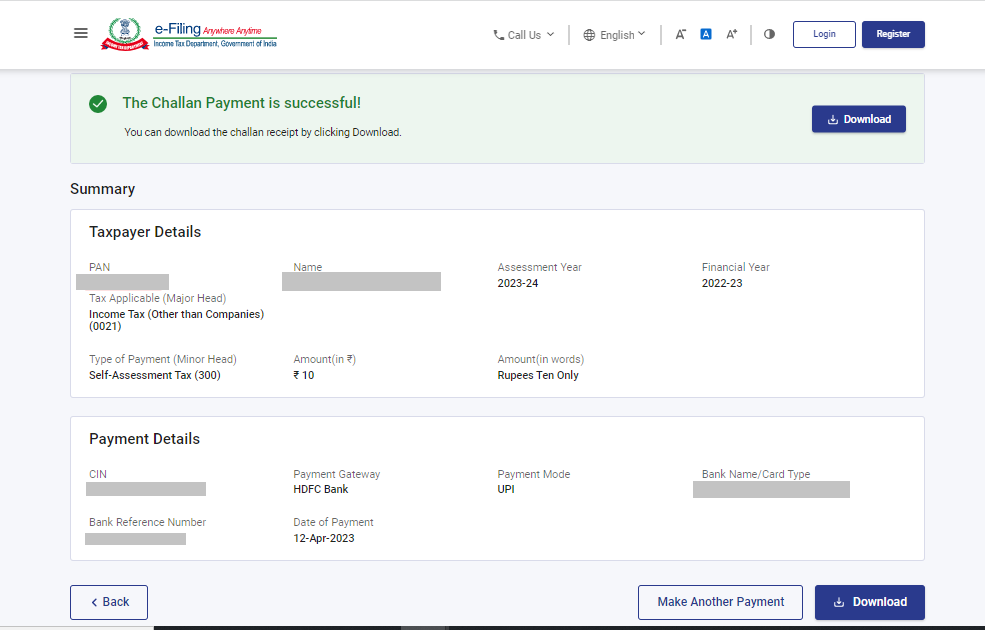

Step 8: Receive Payment Confirmation

- You will receive a confirmation once your tax payment has been successfully submitted.

Note: Remember to download the challan as you will need the BSR code and Challan number to complete the return filing process.